does instacart take taxes out of your check

That W9 you filled out when you signed up with instacart making you a independent earner. Youll include the taxes on your Form 1040 due on April 15th.

Becoming An Instacart Shopper In 2022 The Full Application Process Ridesharing Driver

Lastly the delivery driver is said to make around 15 per hour.

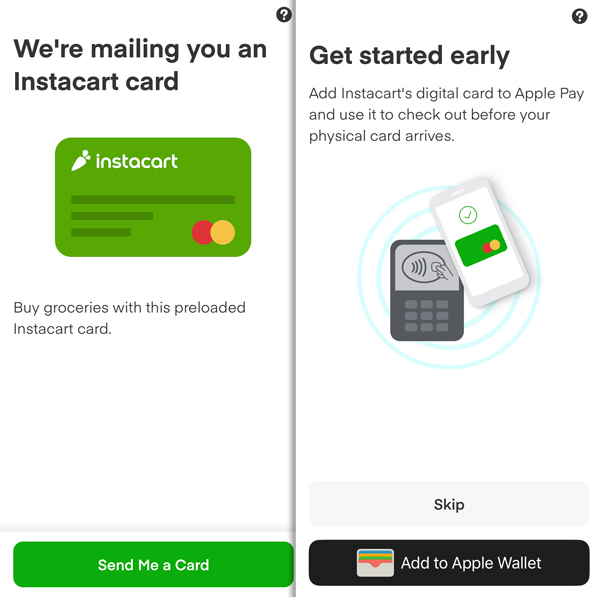

. Instacart pays shoppers weekly on Wednesday via direct deposit for the previous Monday through Sunday week. Instacart pays shoppers weekly on Wednesday via direct deposit for the previous Monday through Sunday week. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

Instacart contracts checkr inc to perform all shopper background checks. 20 minimum of your gross business income. What percentage of my income should I set aside for taxes if Im a driver for Instacart.

Hit Place Order to complete your purchase. Here we go. Credit Karma doesnt cost actual money.

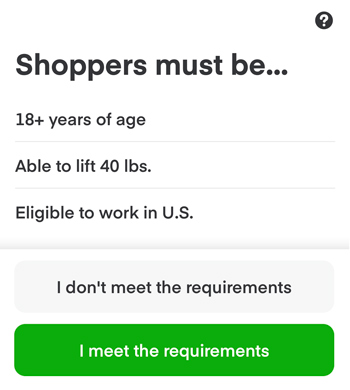

There will be a clear indication of the delivery fee when you are choosing your delivery window. If you have a W-2 job or another gig you combine your income into a single tax return. The email may be in your spamjunk mail folder.

Things like when shoppers get paid how they get paid and what happens if you dont get any orders. If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Free often means there are strings attached. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. If you made over 600 and you did not receive a 1099 contact Instacarts Shopper support right away.

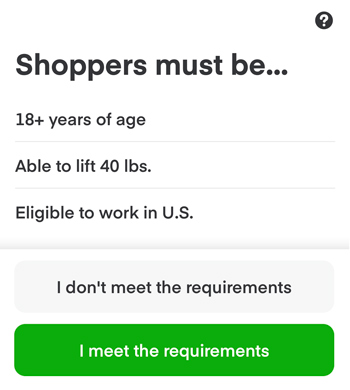

Clear This means that your background check is clear and will not lead to Instacart rejecting you. If you lose your 1099 they can be reached via email at. If you drive as a Lyft 1099 contractor for other rideshare apps or do other part-time gigs on the side.

Please check any other email addresses you may have used to sign up for Instacart or reach out to Instacart to update your email. Deductions are important and the biggest one is the standard mileage deduction so keep track of. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Pending This means your background check is in process. As always Instacart Express members get free delivery on orders 35 or more per. But theres more to know about shopping and driving for Instacart.

What this means is that youll work Monday through Sunday. Instacart processes refunds immediately but they sometimes take 5-10 business days to show in your bank or credit card account. Be sure to file separate Schedule C forms for each separate freelance work that you do ie.

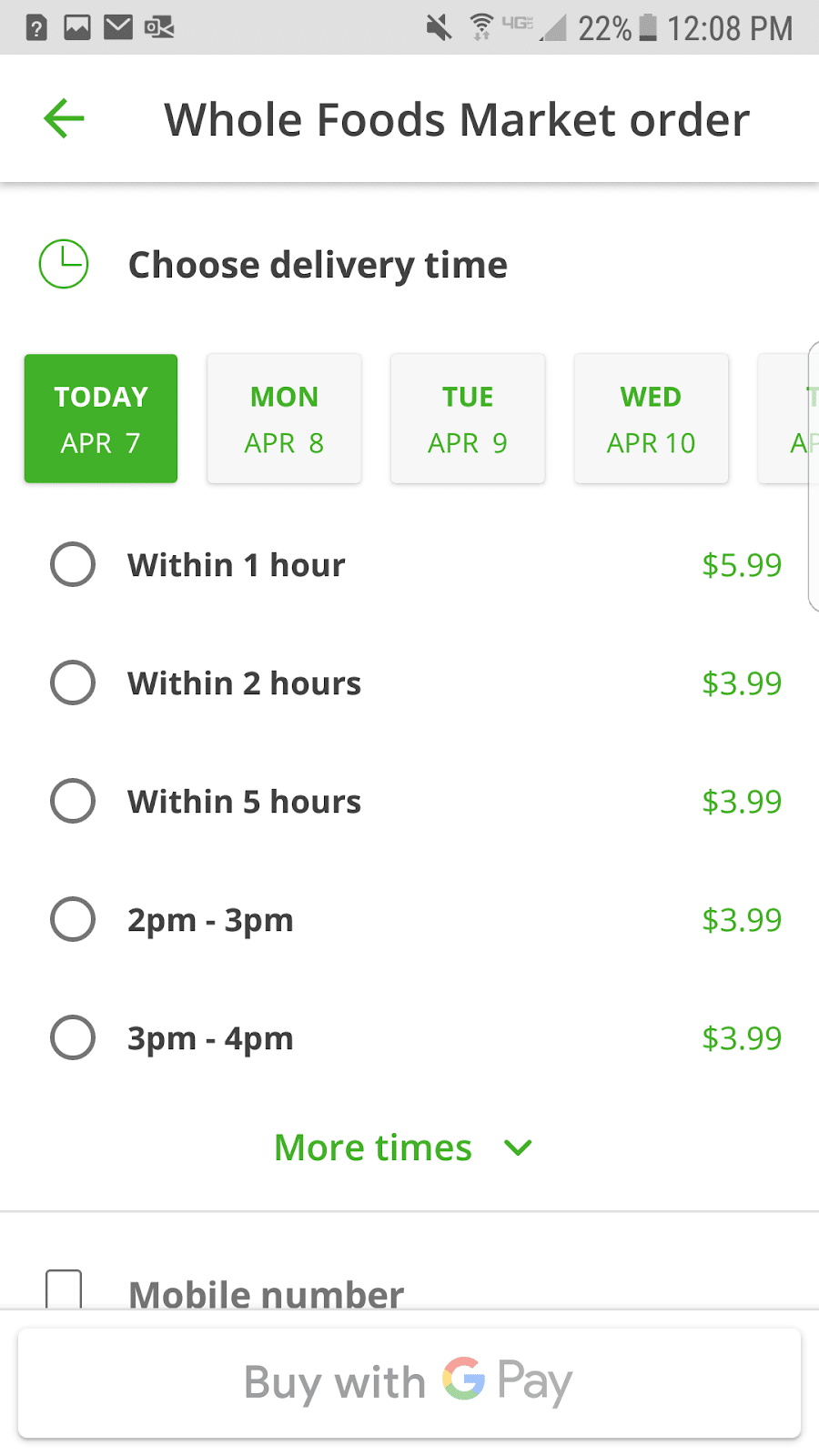

On their website or you can use the Shopper app. Instacart uses Stripe for its online payment service. You can deduct a fixed rate of 585 cents per mile in 2022.

If you cant find a refund in your bank account you may have received a same-day refund. Understand that free isnt always free. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file.

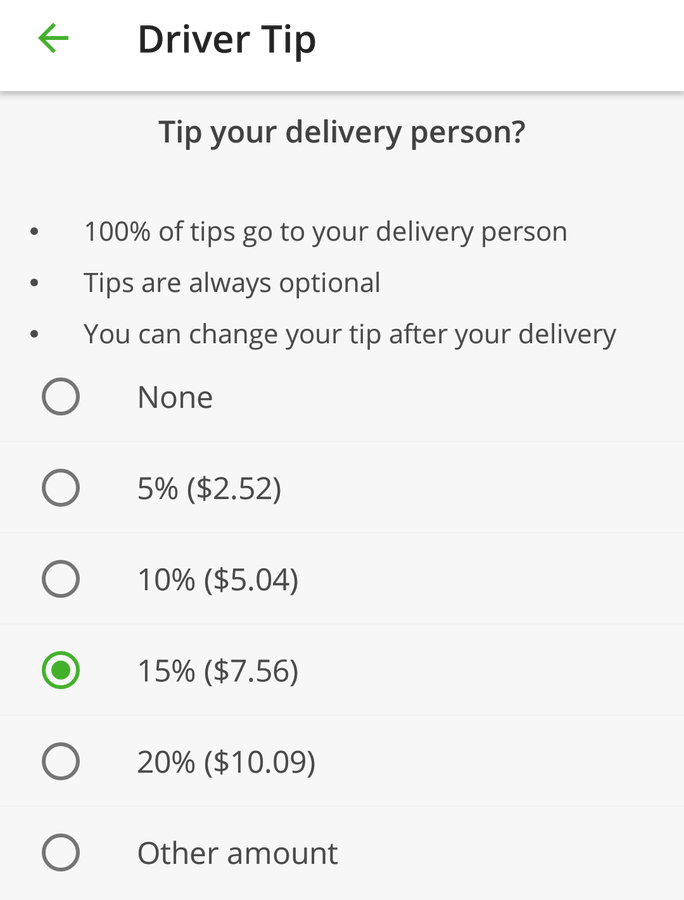

Instacart delivery starts at 399 for same-day orders 35 or more. The service fee youll be charged will be 5 percent of your orders subtotal. This includes self-employment taxes and income taxes.

For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. If you have a smaller order youll be required to pay a minimum fee of 200. Complete This means your background check has been completed but there havent been any conclusions made based on it.

Appeal Property Tax Cook County. Sales tax and a driver tip are not included in this 5 percent. Estimate what you think your income will be and multiply by the various tax rates.

You can file your taxes even as an independent contractor with gig apps like Doordash Uber Eats Grubhub Instacart and others without paying fees. This is what will show up on your bank register when you get paid. Op 2 yr.

Enter your delivery address choose a delivery date and time and enter your payment information. Youll get paid the following Wednesday morning. Most states but not all require residents to pay state income tax.

If you dont have direct deposit set up they will mail you a check. Then if your state taxes personal income youll need to find out the tax rate for your state and withhold accordingly in addition to the 20 minimum for your federal taxes. With each purchase you make youll also be required to pay a 5 percent service fee.

I worked for Instacart for 5 months in 2017. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year. Report Inappropriate Content.

As an independent contractor you must pay taxes on your Instacart earnings. The Standard IRS Mileage Deduction. The estimated rate accounts for Fed payroll and income taxes.

Please search your inbox for an email titled Confirm your tax information with Instacart Instacart does not have your most current email address on file. Practically speaking however drivers will once in a while arrive at that 25 number. For 2021 the rate was 56 cents per mile.

Is Working For Instacart Worth It 2022 Hourly Pay Getting Started Does Instacart take out taxes for its employees. June 5 2019 247 PM. And if you make money outside of Instacart your tax bracket will depend on your entire income not just from shopping for Instacart.

Youre responsible for paying all of your social security contribution along with any state and fed taxespayroll taxes as an independent contractor just like any other small business person. Its typically the best option for most Instacart shoppers. However you still have to file an income tax return.

Different Statuses and What They Mean. This rate covers all the costs of operating your vehicle like gas depreciation oil changes and repairs. The tax rates can vary by state and income level.

For simplicity my accountant suggested using 30 to estimate taxes. Same-day refunds dont appear as separate line items in your bank or credit card statement. Choose Add Promo Code if you have a coupon code to use before checking out.

Accurate time-based compensation for Instacart drivers is difficult to anticipate. An Instacart Shopper then chooses your items from the store and brings them to your door at the scheduled delivery time. The organization distributes no official information on temporary worker pay however they do publicize that drivers can make up to 25 every hour during occupied occasions.

States without income tax include. Missouri does theirs by mail.

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

Instacart Fees Everything You Ll Pay As A Customer Explained

Instacart Pay Stub How To Get One Other Common Faqs

When Does Instacart Pay Me A Contracted Employee S Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Becoming An Instacart Shopper In 2022 The Full Application Process Ridesharing Driver

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Irs Tax Refund Delay Complaints Leave Some Wondering If Stimulus Checks Have Caused More Issues Abc7 Chicago Tax Refund Irs Irs Taxes

![]()

As A New Instacart Shopper I Noticed That After My First Couple Days Of Shopping Many Of The Batches I Receive Notifications On Have Disappeared By The Time I Open The App

When Does Instacart Pay Me The Complete Guide For Gig Workers

When Does Instacart Pay Me A Contracted Employee S Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Shopper Review 2022 Make Money Delivering Groceries

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart 1099 Taxes

Does Instacart Track Mileage The Ultimate Guide For Shoppers